Istanbul property price rises

Istanbul’s success has been much lauded. Even with the turmoil of the last year, Istanbul investment property remains high on local and foreign investors' lists. Last year, Knight Frank said Turkey held opportunities for property buyers. “In the long-term, Turkey is likely to remain on the radar of investors, given the underlying market fundamentals of strong demand set against low supply,” a Knight Frank analyst said.

The Telegraph also placed Turkey in its list of The world's top 20 cities to buy-to-let property early last year, and as recently as last week investment firm Savills IM named Istanbul as one of its “winning cities” for investment in 2017.

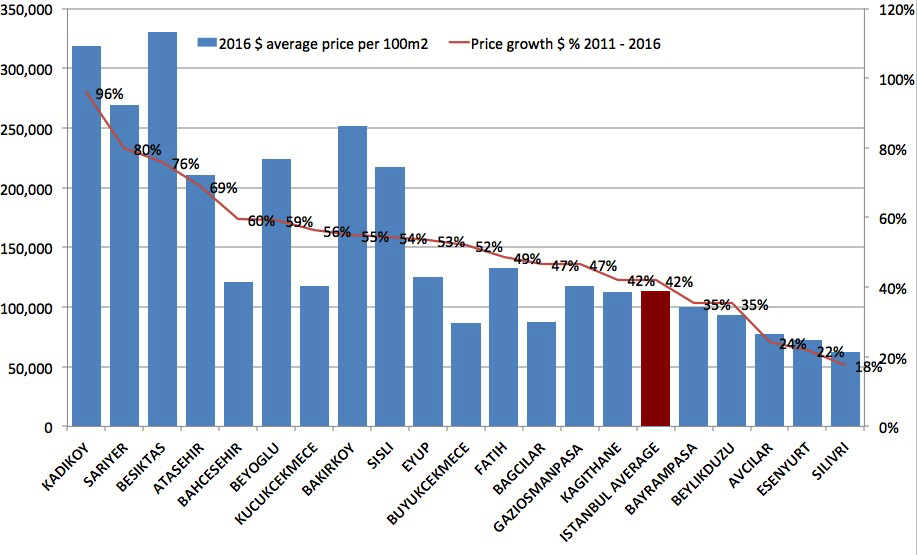

The numbers show us that despite regional and global economic and political turmoil, property in Istanbul grew in value by 42% between 2011 and 2016. This average encompasses the illegal dwellings primed for urban regeneration as well as the city’s most sumptuous properties.

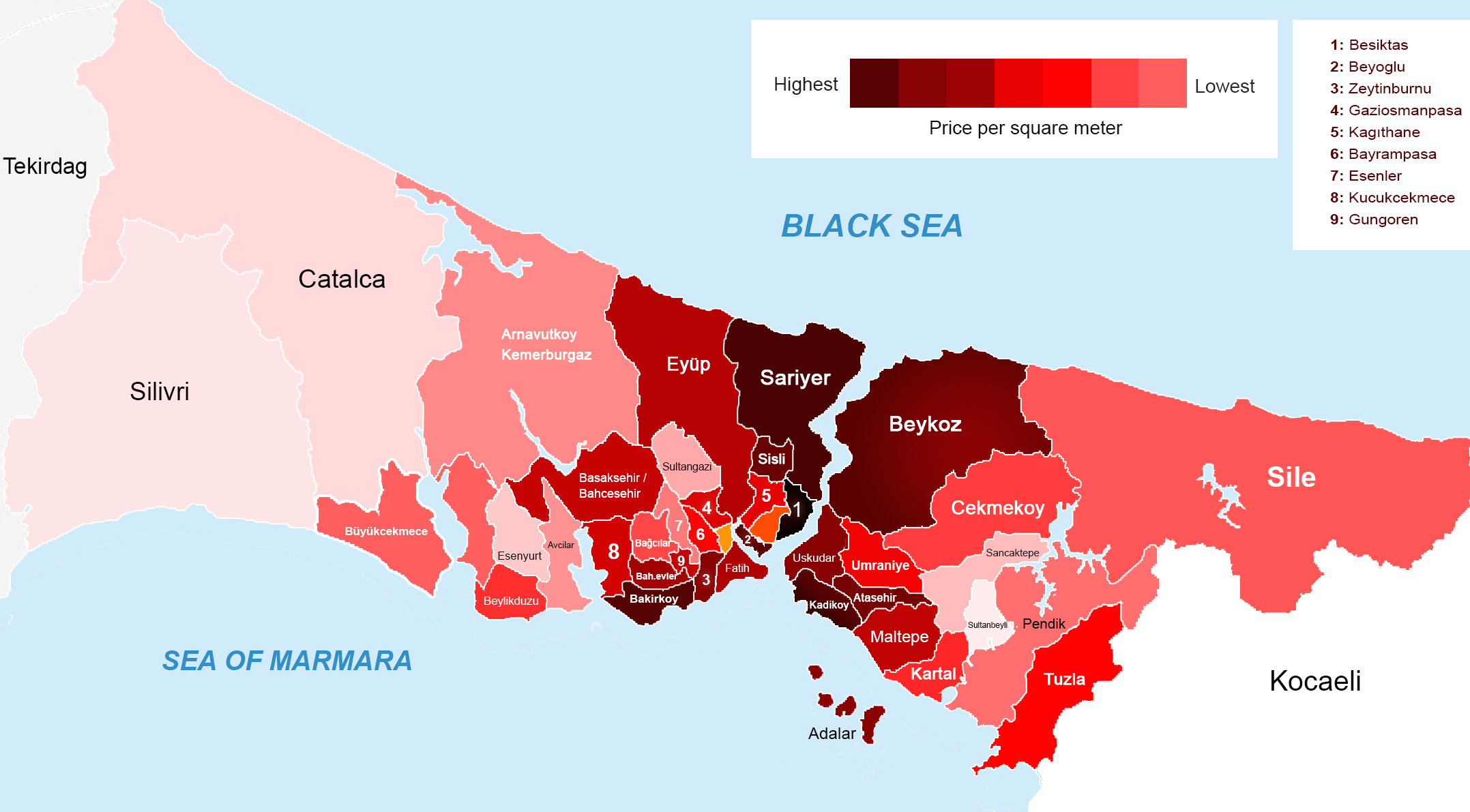

The map, above, shows the Istanbul's property prices as of December 2016. The highest rise in property value was seen in Kadikoy (which you can see on the bottom centre of the map), where prices rose by an average of 96%. Other big hitters in terms of price rises were Sariyer, with 80% gains, and Besiktas, with 76%.

Note: to account for currency fluctuations, all prices are in dollars. Also note that an average is just that: each area described below has a huge variety of property from your basic one-bedroom apartment to expensive luxury penthouses.

Kadikoy

Located on the northern shore of the Marmara Sea, the Kadikoy district faces the European side’s historic city centre. The bustling commercial and transport centre is home to a large Turkish middle class, and with urban regeneration - including the construction new housing projects and recent improvements in infrastructure - it’s becoming a desirable location for city commuters travelling across the Bosporus or - in the near future - to the Atasehir Financial Centre. The Financial Centre is set to house Turkey's largest financial institutions, as well as becoming the regional hub for a number of international companies. As a result, infrastructure is booming in this part of the city, pushing prices up and turning the once-rundown area into a modern cosmopolitan centre.

In December 2011, the average apartment in Kadikoy was priced at $162,000. By December 2016, the same apartment almost doubled in value to $318,000 - a 96% price increase in dollar terms.

WHY INVEST IN KADIKOY?

- 2011 average USD price per 100m2: 162,500

- 2016 average USD price per 100m2: 318,641

- Price growth percentage USD 2011 – 2016: 96%

- Rental yield: 5.9%

- Rental payback period: 17 years

Sariyer

Sariyer is the city’s northernmost district, on the European side. With its long shoreline, the district is popular with weekenders and commuting professionals wishing for natural surroundings away from the hectic city centre. Sariyer’s Bosporus-hugging villages like Zekeriyakoy are becoming more sought-after for this reason.

Like Kadikoy, prices in Sariyer almost doubled in the five years leading up to 2016. The average Sariyer property sold for $149,375 in 2011. In 2016 the average property was $268,960 - an increase of 80%

WHY INVEST IN SARIYER?

- 2011 average USD price per 100m2: 149,375

- 2016 average USD price per 100m2: 268,966

- Price growth percentage USD 2011 – 2016: 80%

- Rental yield: 4.8%

- Rental payback period: 21 years

Besiktas

The Besiktas district is spread along the city’s European shore. Bordered by Sariyer and Sisli, the central area includes upmarket suburbs like Levent and Etilier, as well as some of the city’s most famous palaces.

Between 2011 and 2016, prices grew by 76%, with the average Besiktas property rising from $187,500 to $330,000.

WHY INVEST IN BESIKTAS?

- 2011 average USD price per 100m2: 187,500

- 2016 average USD price per 100m2: 330,000

- Price growth percentage USD 2011 – 2016: 76%

- Rental yield: 5.0%

- Rental payback period: 20 years

Atasehir

This region on the Asian side of the city has received a great deal of publicity in the last couple of years, and not without reason: it’s set to become the city’s financial hub, with a huge financial centre under construction that will house the country and region’s banking and finance headquarters.

It’s hardly surprising that interest in Atasehir property is reaching a peak. The price of an average property grew from $124,375 in 2011 to 210,340 last year. It’s a rise of 69%, above the city average but undoubtedly modest in comparison to future gains.

WHY INVEST IN ATASEHIR?

- 2011 average USD price per 100m2: 124,375

- 2016 average USD price per 100m2: 210,345

- Price growth percentage USD 2011 – 2016: 69%

- Rental yield: 5.9%

- Rental payback period: 17 years

Bahcesehir

Still reasonably priced thanks to its location outside of the city centre, on Istanbul’s European side, the days of affordable property in Bahcesehir are coming to an end. Popular with middle class families and professionals seeking reasonably priced, but quality housing outside the city centre, Bahcesehir is firmly on the radar of new buyers.

Prices increased from $75,625 in 2011 to $120,690 last year: that’s 60% growth. Still one of our prime “get in at the ground floor” spots, you can expect to see steep price growth in Bahcesehir in the next few years as infrastructure connecting this popular part of the city continues to improve and demand increases. Bahcesehir also enjoys proximity and excellent transport links to Istanbul New Airport, which when completed will have a knock-on effect on nearby property prices.

WHY INVEST IN BAHCESEHIR?

- 2011 average USD price per 100m2: 75,625

- 2016 average USD price per 100m2: 120,690

- Price growth percentage USD 2011 – 2016: 60%

- Rental yield: 5.9%

- Rental payback period: 17 years

Kucukcekmece

Bahcesehir’s southern neighbour, Kucukcekmece located on Istanbul’s central European side, and it’s an area currently under massive development. The government has poured millions into urban regeneration and infrastructure development in areas like Basin Ekspres - or Media Highway - which is being developed as a business centre.

Between 2011 and 2016, property in Kucukcekmece rose from $75,000 to $117,240, representing a 56% jump in value. However, at the beginning of this period development was only just getting started - this region has a long way to go in terms of future development and price growth.

WHY INVEST IN KUCUKCEKMECE?

- 2011 average USD price per 100m2: 75,000

- 2016 average USD price per 100m2: 117,241

- Price growth percentage USD 2011 – 2016: 56%

- Rental yield: 5.6%

- Rental payback period: 18 years

Eyup

Between 2011 and 2016 property prices in Eyup rose by 53%, beating out the city average and climbing from $81,619 to $125,199. The central area that extends from the Golden Horn all the way to the Black Sea encompasses some of the European side’s most established and historical neighbourhoods, and with urban regeneration projects beginning to appear in the area, along with improved infrastructure, Eyup is just at the beginning of what is expected to be some of the city’s most favourable price growth.

WHY INVEST IN EYUP?

- 2011 average USD price per 100m2: 81,619

- 2016 average USD price per 100m2: 125,199

- Price growth percentage USD 2011 – 2016: 53%

- Rental yield: 5.9%

- Rental payback period: 17 years

Buyukcekmece

If slow and steady wins the race, Buyukcekmece is definitely a contender. Well outside of the city centre, Buyukcekmece property remains reasonably priced - prices rose 52% between 2011 and 2016, from an average $56,875 to $86,552.

Its location outside the city limits means property here might not appreciate like its closer cousins, but it’s still on an upward trajectory, and should begin to appreciate even more now that Istanbul’s third Bosporus Bridge has been completed, easing the journey into the city for Buyukcekmece commuters. It’s also within easy reach of Istanbul New Airport, which will affect prices in the mid-term future.

WHY INVEST IN BUYUKCEKMECE?

- 2011 average USD price per 100m2: 56,875

- 2016 average USD price per 100m2: 86,552

- Price growth percentage USD 2011 – 2016: 52%

- Rental yield: 4.8%

- Rental payback period: 21 years

Fatih

One of the most historically rich areas in the city, Fatih is located on the European side of Istanbul, on the western side of the Golden Horn. Within the district's areas like Aksaray, Findikzade and Balat Istanbul contains the famous Grand Bazaar and the Spice Bazaar. While urban regeneration continues its march in other parts of the city, a drive to preserve the area's history from UNESCO and the government means property in Fatih tends to be older, restored buildings with architectural significance.

Between 2011 and 2016 average property prices in Fatih climbed 49%, greater than the city average, from $89,231 to $132,132.

WHY INVEST IN FATIH?

2011 average USD price per 100m2: 89,231

2016 average USD price per 100m2: 132,132

Price growth percentage USD 2011 – 2016: 49%

Rental yield: 5.3%

Rental payback period: 19 years

Gaziosmanpasa

Still affordable Gaziosmanpasa apartments come in at an average price of $117,241, a 47% increase on 2011’s average of $80,000. The central area on Istanbul’s Golden Horn is another region where urban regeneration is taking place at breakneck speed. New housing developments are attracting middle class Turkish professionals looking for property within easy reach of the city centre at favourable prices. The price rises seen over the past few years are likely to accelerate as development continues and infrastructure improves.

WHY INVEST IN GAZIOSMANPASA?

- 2011 average USD price per 100m2: 80,000

- 2016 average USD price per 100m2: 117,241

- Price growth percentage USD 2011 – 2016: 47%

- Rental yield: 5.6%

- Rental payback period: 18 years

Kagithane

Once an inner-city ghetto, Kagithane is undergoing massive change as the government invests heavily in local infrastructure and demolishes illegal housing. Located on the European side, central Kagithane neighbours affluent Sisli, which alone ensures future price growth.

Between 2011 and 2016 Kagithane property prices grew by 42% - in line with Istanbul averages - moving from $79,303 to $112,759.

WHY INVEST IN KAGITHANE?

- 2011 average USD price per 100m2: 79,303

- 2016 average USD price per 100m2: 112,759

- Price growth percentage USD 2011 – 2016: 42%

- Rental yield: 5.3%

- Rental payback period: 19 years

Bayrampasa

Here’s another central area where the association of nearby affluent regions will affect price growth in years to come. Located on Istanbul’s European side, rubbing shoulders with wealthy Beyoglu, urban regeneration in Bayrampasa is expected to have a drastic effect on property prices.

Between 2011 and 2016 Bayrampasa property prices increased by 35%, slightly under the Istanbul average, from $73,871 to $100,085.

WHY INVEST IN BAYRAMPASA?

- 2011 average USD price per 100m2: 73,871

- 2016 average USD price per 100m2: 100,085

- Price growth percentage USD 2011 – 2016: 35%

- Rental yield: 5.6%

- Rental payback period: 18 years

Beylikduzu

Beylikduzu property price growth was 35% over the five-year period, rising from an average price of $68,750 to $93,103. A flood of housing stock in the area has kept prices low, which is excellent news for lower-income Turkish workers wishing to own property, but not as good for investors, since prices are set to remain low for the foreseeable future.

WHY INVEST IN BEYLIKDUZU?

- 2011 average USD price per 100m2: 68,750

- 2016 average USD price per 100m2: 93,103

- Price growth percentage USD 2011 – 2016: 35%

- Rental yield: 5.6%

- Rental payback period: 18 years

Bagcilar

Its proximity to Basin Ekspres/Media Highway on the city’s European side is about to open Bagcilar to a world of opportunity. Price growth was 47% over our five-year period, with the average property price moving from $59,655 to $87,431.

Investment in local infrastructure, urban regeneration and proximity to some of the city’s most affluent areas - including Atakoy and Bakirkoy - mean a more pronounced price growth in the immediate future.

WHY INVEST IN BAGCILAR?

- 2011 average USD price per 100m2: 59,655

- 2016 average USD price per 100m2: 87,431

- Price growth percentage USD 2011 – 2016: 47%

- Rental yield: 5.6%

- Rental payback period: 18 years

Esenyurt

Esenyurt is another area where a flood of cheap housing has slowed property price movement. Between 2011 and 2016 Esenyurt property values grew by 22%, from $59,375 to $72,414. An excess of property on the market and a reputation as a low-income area means prices are not expected to accelerate in line with future city averages.

WHY INVEST IN ESENYURT?

- 2011 average USD price per 100m2: 59,375

- 2016 average USD price per 100m2: 72,414

- Price growth percentage USD 2011 – 2016: 22%

- Rental yield: 5.3%

- Rental payback period: 19 years