This year is set to be another significant year for Turkish property. We outline the factors influencing Turkey’s real estate sector in 2018.

2017 in review

Last year saw great change for Turkey’s political system and the wider economy. A referendum heralded a new presidential system, led by President Erdogan, in an attempt to keep Turkey on the path to prosperity it has followed since his ruling party came to power in 2002. Erdogan’s subsequent economic reforms boosted the economy, leading to an extraordinary 11 percent fourth-quarter growth. Existing trade ties were strengthened, and new trading links forged. A push by the country’s tourism industry to redress 2016’s low tourist numbers bore fruit, with arrivals rebounding by almost 30 percent in 2017.

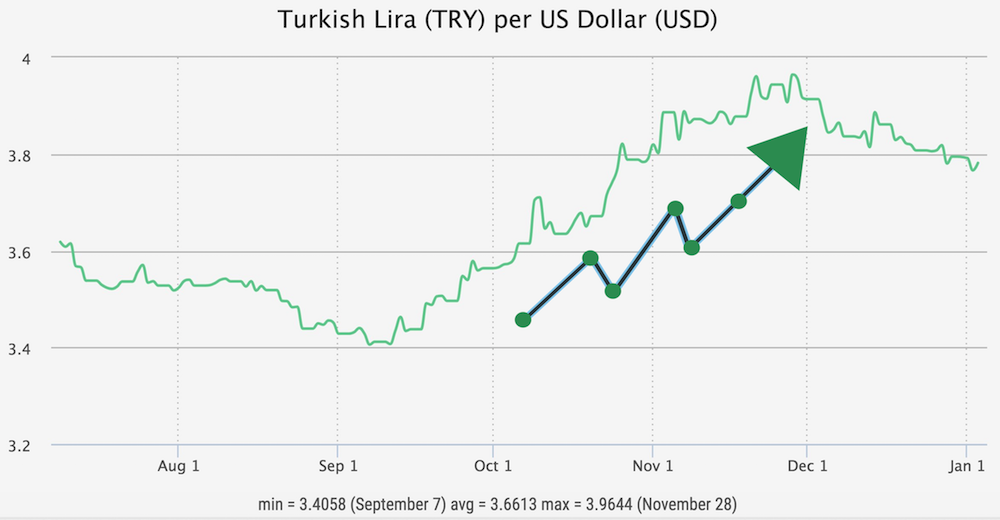

In 2017, we also saw big leaps in Turkey’s real estate market. The rollout of a government scheme offering citizenship for foreign nationals investing at least US$1m in property precipitated a flurry of investment. This measure, coupled by a depressed Turkish Lira, meant foreign real estate purchases accounting for half of foreign direct investment in 2017, marking the first time in Turkish history that real estate purchases have topped other FDI.

Here are our predictions for 2018 and beyond.

Middle Eastern buyers will continue to dominate

Turkey’s appeal as a stable country with Islamic cultural values means its popularity with Middle Eastern property buyers is higher than ever. In 2017, Saudis topped the list of foreign buyers, followed by Iraqis, Azerbaijanis and Kuwaitis. These Middle Eastern buyers, seeking safe investments outside their own countries, will also be the most likely to opt for citizenship by investment in Turkey.

With Istanbul asserting its position as a centre for finance, and Turkey’s wider fundamentals cementing its position as a global economic leader, we will see this phenomenon continue into the year and beyond. This trend will be driven by a few factors in 2018:

The Trump administration

As US President Donald Trump continues his hostile stance towards Muslims within the US and abroad, investor sentiment towards the once-safe haven of US investment is changing. Capital from the Middle East into the US real estate sector dropped by 71 percent last year compared to 2016. While this is partly due to low oil prices, a corresponding rise elsewhere - such as investment in Turkey - shows there is still capital to be invested, indicating that the drop is due to uncertainty over Trump’s political direction.

Large Islamic investment companies and wealthy individuals are looking for alternative investment destinations, and one such safe haven is Turkey

Property Turkey director Cameron Deggin says Trump’s actions have precipitated a seismic shift in the world of investment. “We’re seeing a huge shift in funds from the US to Turkey. And I’m not just talking about individuals: large investment groups are quietly pulling out of the US.”

Unrest in the Middle East

Regional unrest will continue to divert the flow of investment towards the relatively safe haven of Turkey.

- Saudi Arabia: In Saudi Arabia, the new Crown Prince Mohammed bin Salman’s anti-corruption campaign saw 159 of the kingdom’s wealthiest citizens - including members of his own family - detained in November. To avoid prosecution, the individuals will be coerced into signing over billions of dollars worth of assets. The measure is causing waves among the rest of the country’s elite, many of whom will be urgently looking for investment havens out of the reach of the autocratic Crown Prince. Saudi Arabia is currently the largest foreign investor in Turkish property, so the precedent is set for greater levels of investment under the current conditions.

- Iran: Demonstrations against a sluggish economy and rising living costs in Iran have prompted widespread criticism of the current government, the greatest challenge to the Iranian government’s authority since the 2009 protests. Iranians are significant investors in Turkish property and the uncertainty will only fuel demand as wealthy Iranians look outward for safe investment alternatives.

- Wider Middle East: Trump’s decision to shift the US Embassy from Israel to Jerusalem was a powerful statement, and one experts in Middle Eastern conflict agree will likely precipitate regional unrest, fuelling investor necessity to diversify investment outside the region.

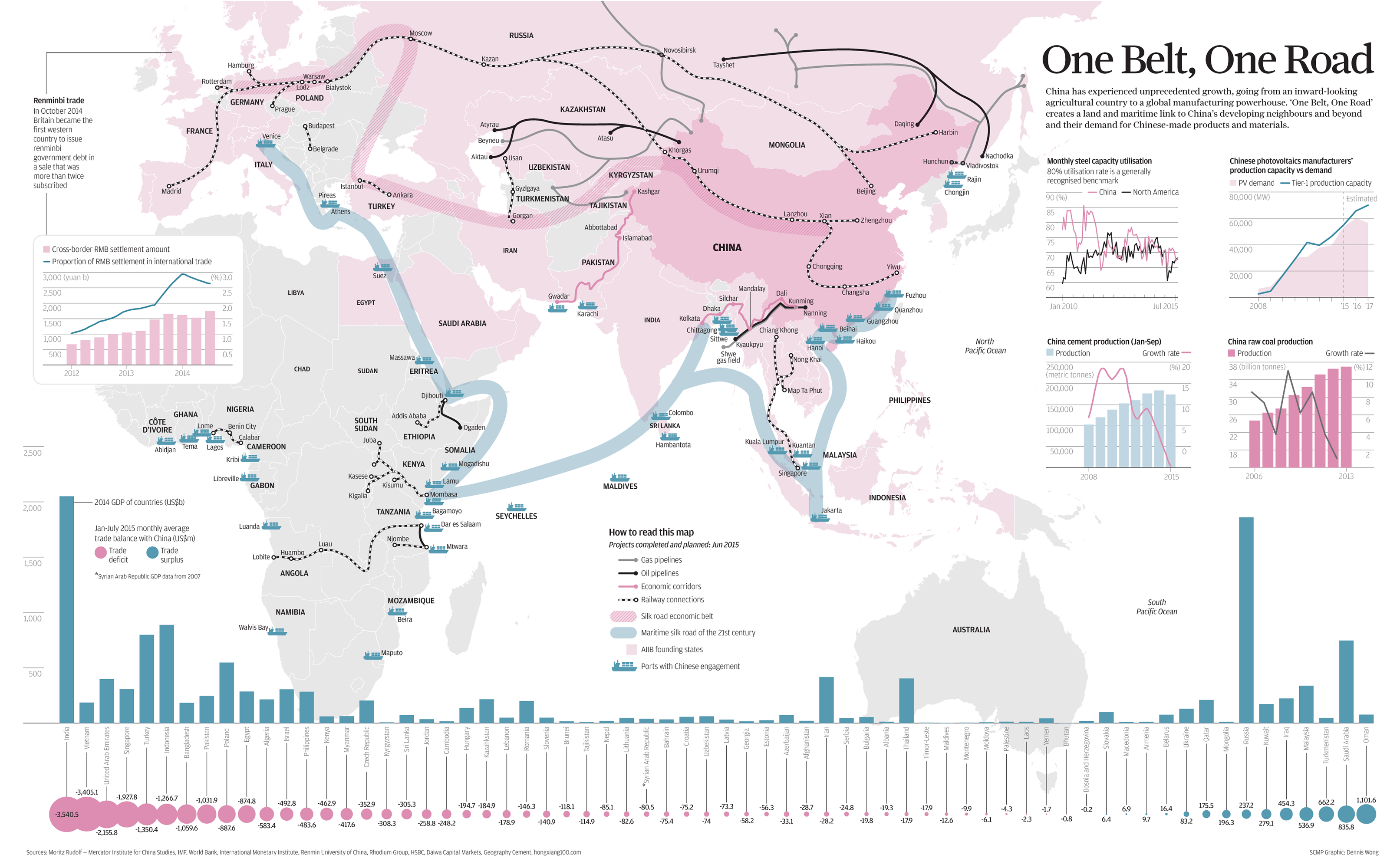

The rise of Chinese investors

China is set to invest billions of dollars in Turkey over the coming years as part of its global Belt and Road Initiative. The mammoth investment, which aims to connect China with European, North African and Middle Eastern markets, has put Turkey firmly on the radar of Chinese investors, as well as tourists.

According to investment and promotion agency Invest in Turkey, the number of Chinese companies operating in Turkey is set to double in the next three years as Chinese investment firms channel money into infrastructure, IT, energy, chemicals - and property.

Recently, Chinese investors overtook the US to become the biggest investors of foreign real estate in the world, investing more than $20bn each year. And Turkey is on the radar.

Deggin says unlike other foreign investors who stick to certain areas, Chinese property buyers are buying up large in a number of Turkish locations.

“In 2017 we saw Chinese investing all over the country, from villas in Ovacik to apartments in Istanbul. Chinese investors are cautious, and the move to invest in Turkish real estate has been gradual. However, now investors have a foot in the door, so to speak, they are investing significantly, and we expect the volume of real estate sales to Chinese investors to really ramp up in 2018.”

Russians will return

Soured relations between Russia and Turkey saw numbers of visiting Russians drop significantly in 2016. This precipitated a corresponding dip in the volume of properties sold to Russians, who had previously invested heavily in apartments and villas in Antalya, Bodrum and Fethiye property.

However, 2017 saw a return to form after Russia lifted its sanctions against Turkey, and Russian tourists began to return, with an increase of around 30 percent over the preceding year. Tour operators are gearing up for a bumper season this year as Russians prepare for their summer holidays in Turkey - and developers are readying themselves for a corresponding rise in the number of Russian property buyers.

Domestic market will fuel price growth - and offer an exit strategy

Improving fortunes for Turkey’s rapidly-growing middle class has buoyed domestic demand for property. Turkey’s young population is increasingly educated, driving an innovative and ambitious workforce.Per capita income has risen and people are having children later in life, factors which have increased disposable income, driving an appetite for consumer goods, holidays and of course, real estate. The government is fuelling the home buyer sector, supporting banks in offering low interest rates, low deposits, and high proportions of finance.

Deggin says last year’s boost was just the beginning. “Last year saw domestic property market gather steam, and I expect the next five years will see more and more buyers opting into the new Turkish dream of home ownership.”

Domestic demand has a positive knock-on effect for investors, Deggin explains. “Investors are realising that these new home buyers represent an exit strategy. The investor who buys in 2018 will sell in three or four years to an established home buyer’s market, making a respectable profit.”

A stronger lira and economy = investor gains

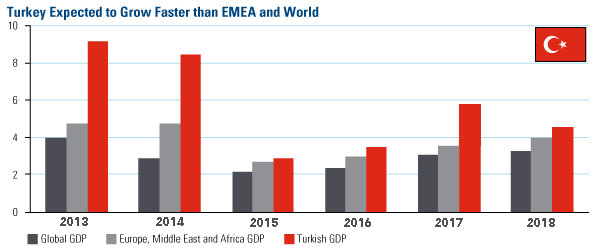

Having almost reached four Turkish lira to the US dollar, the lira strengthened in the last quarter of 2017, rebounding to 3.75TL against the dollar. At the same time, Turkey announced the economy had exceeded predictions by growing 11 percent in the final quarter, pushing the annual growth rate to almost 6 percent.

In 2018, Turkey’s growth is expected to beat EU averages by almost 2.5, as well as outstripping global giants like the US and emerging markets like India and China. The lira is expected to stay around the 3.60 to 4.00 level, a relatively stable result that will bolster stability and investment confidence.

Istanbul’s reign will continue

Deggin, who is working and living in Istanbul, says sales of real estate in Turkey’s largest city will continue to drive the sector. He predicts foreign direct investment in Istanbul real estate will grow by 35 percent over 2017, while domestic transactions will increase by around 15 percent. “Since foreign purchases account for around seven percent of the total Istanbul market, the uplift in domestic demand is very good news for foreign buyers looking for strong exit routes for their assets,” he says.

Deggin’s top spot for investors in 2018 remains the Basin Ekspres (Media Highway) region of Istanbul. “We strongly recommend an investment this year before prices in the area start reaching the levels of neighbouring areas that have already peaked.”

There are many projects in Basin Ekspres, and Deggin urges investors to choose wisely. “Our top tip for investors in this area is to identify projects that would have strong demand from Turkish home buyers. The strongest investment is always the one with an assured exit strategy.”

Read more: five reasons to invest in in Basin Ekspres property in 2018.