Turkish Central Bank decided last night (28 January 2014) to raise overnight lending rate from 7.5% to 12% despite strong opposition from Prime Minister Erdogan.

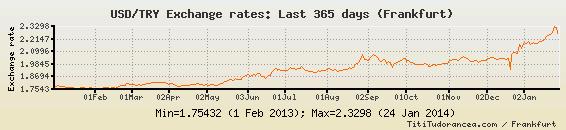

The hike in the interest rates came after an emergency meeting held on 28 January 2014. Central Bank also increased the overnight borrowing rate from 3.5% to 8% in an attempt to rescue the plunge of Turkish Lira, which depreciated by 18% against USD in the preceding 90 days. In a statement made today, Central Bank stood by its decision to increase rates and pointed to the inflationary factors in the economy. Inflation was reported as 7.4% in December 2013.

The hike in the interest rates came after an emergency meeting held on 28 January 2014. Central Bank also increased the overnight borrowing rate from 3.5% to 8% in an attempt to rescue the plunge of Turkish Lira, which depreciated by 18% against USD in the preceding 90 days. In a statement made today, Central Bank stood by its decision to increase rates and pointed to the inflationary factors in the economy. Inflation was reported as 7.4% in December 2013.

The Bank hopes to make Turkish Lira more attractive for foreign investors putting their funds in Turkey thus boosting the value of Turkish currency. Turkish Lira is not the only emerging market currency which saw significant slides in 2013. India, South Africa, Brazil and Russia saw their currencies rapidly lose value amidst harsh withdrawal by the US of its stimulus measures. The US quantitative easing policy, whereby US government has been buying billions of Dollars of long-term debt in an effort to stimulate its own economy, has had a negative impact on emerging economies such as the BRICS (Brazil, Russia, India, China and South Africa). India saw its currency devalue in excess of 30% against USD since summer 2013. Relatively speaking, Turkish currency has been more resilient and the Turkish Central wowed to rescue its further slide.

Immediately upon the announcement of the interest rate hike, Turkish Lira moved from 2.33 to 2.15 against USD in today's (29 January 2014) trade. Analysts expect Turkish Lira to stabilise at around 2.1 against USD in coming months of trade. Turkish Central Bank has warned, however, that the recovery will not be imminent, in fact that the Lira may further depreciate in the coming weeks before it reverses to strengthen again.

Immediately upon the announcement of the interest rate hike, Turkish Lira moved from 2.33 to 2.15 against USD in today's (29 January 2014) trade. Analysts expect Turkish Lira to stabilise at around 2.1 against USD in coming months of trade. Turkish Central Bank has warned, however, that the recovery will not be imminent, in fact that the Lira may further depreciate in the coming weeks before it reverses to strengthen again.

In an interview with the media on 28 January prior to the announcement, Erdem Basci, the governor of Turkish Central Bank, said that the Bank was totally independent from the government and would not hesitate to tighten up monetary policy if needed. He added, contrary to some investors' assertions, that the Bank would not give in to pressures from the government and would do all that was necessary to rescue Turkish Lira and prevent inflation from rising.

In an interview with the media on 28 January prior to the announcement, Erdem Basci, the governor of Turkish Central Bank, said that the Bank was totally independent from the government and would not hesitate to tighten up monetary policy if needed. He added, contrary to some investors' assertions, that the Bank would not give in to pressures from the government and would do all that was necessary to rescue Turkish Lira and prevent inflation from rising.

Prime Minister, Tayyip Erdogan, had been a strong opponent of an interest rate increase leading up to elections in March 2014, warning that a hike would hurt Turkish public by increasing the cost of borrowing. Global analysts and investors have generally perceived the move by Turkey's Central Bank as a bold yet positive one, one that indicates an independent monetary policy structure within the Central Bank. This is a particularly important perception by foreign investors due to the fact that Turkish Government, particularly Prime Minister Erdogan, have recently been criticised for being too authoritarian. The corruption claims that shook the government in the very last chapter of 2013 did not help confidence either.